Cover Life’s Final Costs with Confidence

Protecting Your Loved Ones with ReliableLife Insurance Solutions

Our Mission

At Heritage Life & Legacy, we are dedicated to providing peace of mind by offering final expense insurance coverage tailored to your unique needs. Our goal is to help families navigate difficult times with confidence, knowing that essential end-of-life expenses are covered with care and compassion.

Coverage

Crafting extraordinary events tailored to your unique vision.

Final Expense Insurance

Ease the burden on your family during difficult times with our Final Expense Insurance, covering funeral and other end-of-life expenses.

Term Life Insurance

Our affordable Term Life Insurance offers a death benefit for a specified term, ensuring your loved ones' financial stability in case of any unfortunate events.

Whole Life Insurance

Secure your family's future with our Whole Life Insurance, providing lifelong protection and a cash value component for added financial security.

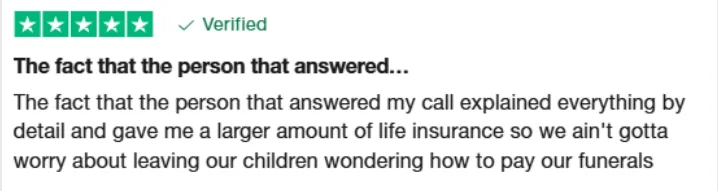

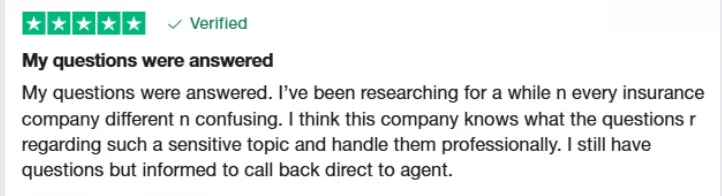

Testimonials

Frequently Asked Questions

Common Questions Answered for your convenience.

How much does final expense insurance typically cost?

Premiums vary depending on your age, health, and the amount of coverage you choose, but final expense policies are generally affordable and come in fixed monthly payment options.

Do I need a medical exam to qualify?

Most final expense insurance policies are no-exam or simplified issue, meaning you only need to answer basic health questions. No lab work or doctor visits are required.

How much coverage can I get?

Coverage amounts typically range from $2,000 to $50,000, depending on the insurer and your personal needs.

How quickly are benefits paid to my beneficiaries?

Once the necessary paperwork is submitted, benefits are often paid within a few days—helping your family cover immediate expenses without delays.

Can my premiums increase over time?

No, most final expense policies offer fixed premiums, meaning your monthly payment will never go up as you age or if your health changes.

Can I get coverage if I have health issues?

Yes, many final expense plans are available to individuals with pre-existing conditions. Guaranteed issue policies are even available with no health questions asked, though they may have a waiting period.